Fireblocks is a leading digital asset security and transfer platform that provides institutional-grade solutions for managing, storing, and moving cryptocurrencies and other digital assets. It was founded in 2018 by cybersecurity experts Michael Shaulov, Idan Ofrat, and Pavel Berengoltz to address the critical vulnerabilities in transferring digital assets safely.

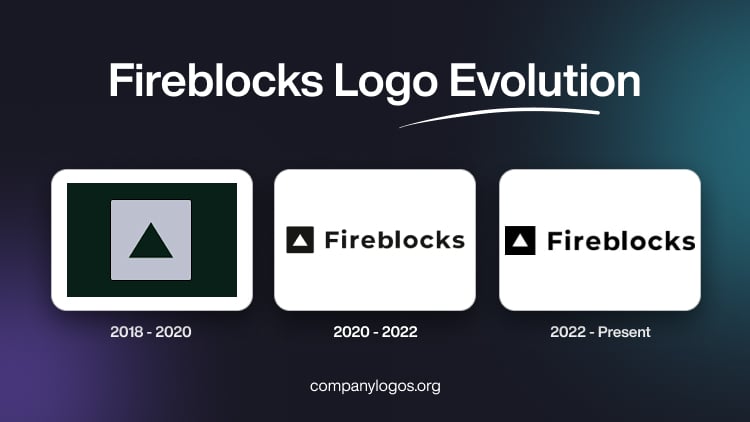

The Fireblocks logo has evolved since the company’s inception in 2018. It reflects its journey from an innovative blockchain security startup to a mature global provider for digital assets infrastructure. The article delves into the evolution of the Fireblocks logo, among other details.

The Genesis of the Fireblocks Logo (2018 – 2020)

The original Fireblocks logo featured a flat graphical emblem consisting of a minimalist block symbol in black and a stylised triangle in white.

(2020 – 2021)

The first logo change saw its enhancement using three-dimensional effects. It aimed to convey a sense of structure and security.

(2022 – Present)

The current Fireblocks logo was introduced in 2022, and it has retained the core elements of the triangle-inspired motif. However, its polished and modern appearance aligned with the established presence of the company.

The Elements of the Fireblocks Logo

Font

The Fireblocks logo wordmark has used a sans-serif typeface to convey clarity and technical expertise.

Colour

The colour palette of the Fireblocks logo consistently leverages dark blue or black for the logo mark and text. The colour palette is combined with a white background to ensure strong contrast and excellent digital legibility.

Finally

The evolution of the Fireblocks logo reflects the journey of the company from a startup addressing cryptocurrency security to a global leader in institutional digital asset infrastructure. The logo iterations show the mission of Fireblocks, that is, providing trusted, innovative, and enterprise-grade solutions for the rapidly evolving digital asset ecosystem. Today, the logo is more than a symbol; it represents safety, reliability, and cutting-edge technology.